If you read today’s summary, you may be wondering why I sold almost all my big gainers. Well, besides not being entirely convinced in this rally (as Woodshedder points out, volume was nothing special), I also wanted to book as much profit off the options’ time value as possible.

Time value is a unique concept to options and is an important factor in determining the premium that has to be paid per each contract. Whereas a stock’s value is simply based on its price, an options’ premium is the sum of its intrinsic value and time value.

Intrinsic value is simple to see; it is simply the difference between the options’ strike price and the current price of the underlying stock. Intrinsic value cannot be negative, thus only in-the-money (ITM) options can have any. (So ITM calls have a strike price that is below the underlying stock’s current price, and, conversely, ITM puts have a strike price that is above the underlying stock’s current price.) Options that are at- (ATM) or out-of-the-money (OTM) do not and cannot have any intrinsic value. This must not be forgotten, since at expiration, all that is left is intrinsic value. (Consequently, intrinsic value can also be referred to as ‘real value’.)

Time value (aka. ‘extrinsic value’; its rate of change is denoted by the Greek letter theta) is the trickier part of the equation. It depends on 2 main factors:

- Time until expiration

The more time remains for the options to become ITM, the higher the likelihood will be that it will actually do so. Option with a high(er) chance of becoming ITM will command higher premiums. So options that are 1 strike out of the money will be more expensive than the ones that are further out.

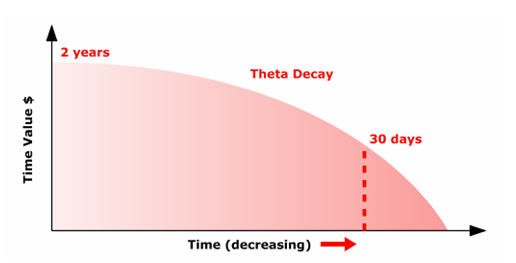

This value decays exponentially, so the closer it gets to expiration date, the more value it loses. For the mathematically challenged, here’s a picture of the exponential decay (credit: Illuminati-Trader):

- Volatility of underlying stock

This essentially embodies the risk inherent in the option, whether it is implied or historic. Higher volatility comes from larger than normal swings in the stock’s price and/or momentum. This results in higher risk for both sellers and buyers (sellers risk the option expiring ITM, while buyers risk expiring OTM), thus premiums increase.

The time value is thus determined by combining the premiums from these 2 factors*. They are both important, but at expiration, time value always equals 0, regardless of volatility.

So when an underlying stock goes through a large price swing, volatility goes through the roof (relatively speaking) and the time value increases accordingly. This extra/added value is lost as soon as price action settles back to a normal range.

Since large up or down days in a stock are more often than not followed by consolidation/smaller swings in price (during which time volatility decreases), I tend to sell (at least part of) a position, to capture that added time value.

*It’s a bit more complicated than a simple summation of course, but that’s beyond the scope of right here/right now. For those who like differential equations, feel to read up on the Black-Scholes Model…or check out the Binomial Method, or the uber-complicated Monte Carlo Sims.

If you enjoy the content at iBankCoin, please follow us on Twitter

good stuff

not exponential decay, it starts out hardly losing value at all and then it accelerates towards the end, exponential decay, the model you show, will never hit 0

the real model looks something more like this

<img src=”http://www.illuminati-traderblog.com/wp-content/uploads/image/Time%20Decay.jpg

Thanks ‘m’ for the better picture.

(Was trying to find an option specific one last night, but my search skills failed me…so I put up a generic time decay graph.)

Thanks for this write up. New pic makes more sense 🙂