Let’s take gander back at Friday’s options activity…as you recall, on Thursday I was having a bit of double-guesser, trying to figure out whether the institutional players were correct with all their (assumed) hedging via egregious amounts of puts.

Off the high ratio reading on Thursday, the ‘blindly contrarian’ paperTrades went long with some SPY May09 87. calls at Friday’s open – buying 10 contracts at $2.50 each – and were showing 15% profit once all trades were settled at EOD. The plan now is to close these out at Monday’s open, keeping with the theory that a short-term indicator is only good for short-term trades. So unless we get a gap down, we are looking at a decent win for this ‘system’.

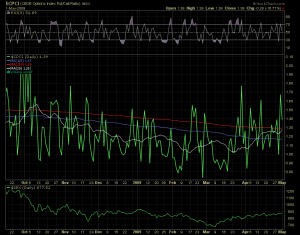

Friday’s nondirectional market drove the put/call ratio down a skosh to 1.39. (‘Skosh‘ is my shout-out to the rather random Truman/A-Bomb discussion that developed on ‘The Fly’s tab earlier today.)

While 1.39 is fairly high, it isn’t high enough to signal another contrarian long entry, especially when compared with the reading from the day before.

The equity put/call ratio ($CPCE) followed the same pattern and dropped slightly, staying well in bullish territory although not at any extreme.

Some speculative items from Friday:

- As expected, DRYS call options volume exploded after EPS, although the action was concentrated in front month, ATM strikes, perhaps indicating not quite unbridled bullishness…

- Some speculative calls, 9k+ strong, in SUN at the May 30. strike, ahead of earnings on Wednesday.

- Similar action in garbagio VMED…over 10k June 10. calls traded on Friday, ahead of Monday’s after-hours EPS announcement.

- Opposite (strong) speculation in MCHP May & June 22.50 puts ahead of EPS on Thursday.

- And some long term bearishness seen in TXN, with an egregious 25k strong put trade with October 20.’s. In 1 single trade, almost $9mil (!!!) worth of puts were purchased! Gotta love it!

ELN and its calls going nuts on apparent takeover rumours[sic]. Wasn’t this somebody’s favourite[sic] ticker not too long ago?

Of course, they’re still only at $7.

__________

Egregious call volumes also in AA & MON (apparently many out there read the Jakester).