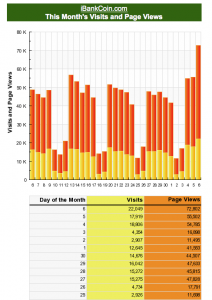

Check out the traffic boost from today’s rant from yours truly against a certain Norwegian referee whose atrocious calls prevented my boys of Chelsea from reaching their 2nd successive Champions League Final:

Granted, I don’t have enough access to drill deeper down into the site stats, but the coincidence of my post and the noticeable traffic boost for a Wednesday cannot be ignored!

Yeah, baby! That’s how we roll in KoPGland – home of the _international-internet_ unwashed masses!

But back to more mundane things…

Based on yesterday’s low reading of 0.80, we opened a virtual tracking trade with SPY May’09 93. puts at the open. These are currently down by about 13%, so unless we get a big gap down, this trade will be a loser.

Today, the put/call ratio rose back into the neutral zone and currently stands at 1.20. So there is no new entry for tomorrow.

Individual Items:

- A couple things that I noted in The PPT as well:

- EXM May 10. call volume outpaces open interest 3:1 as it doubles on the day – the one known as vcutrader nailed this one first and good.

- AAPL May ATM call options volume spikes on 3G-enabled computer rumors (http://bacn.me/4lm and http://bacn.me/4lj)

- NVDA (not to be confused with VNDA!) put volume far outpaces call volume ahead of Thursday’s earnings. Action concentrated in June 10. puts.

- XLF volatility near 7 month low, yet WFC volatility well above average…stress test surprise expected?

- Today’s buyout chatter quota: INFA, JEC