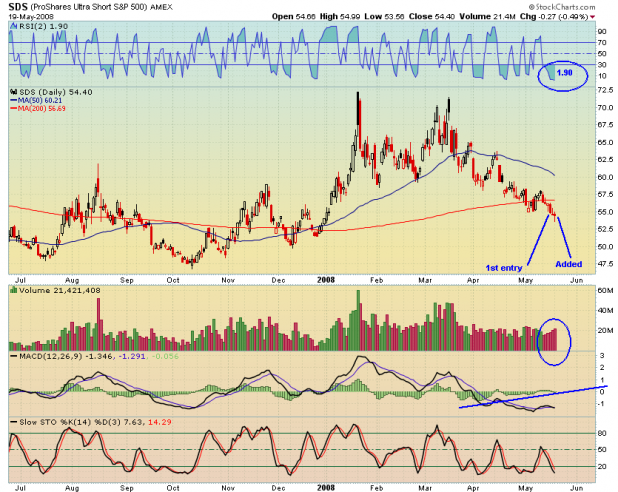

On Thursday, the RSI(2) strategy triggered an entry into [[SDS]]. I took the signal (unfortunately early) and established a postion before the close Wednesday. In order to follow the strategy, the buy of SDS should have occured Friday morning.

The strategy is still signaling entry into SDS as RSI(2) < 10. Therefore, I added to the postion this morning, and since the S&P ultra short ETF is still signaling an entry, I will add to this position on the open Tuesday.

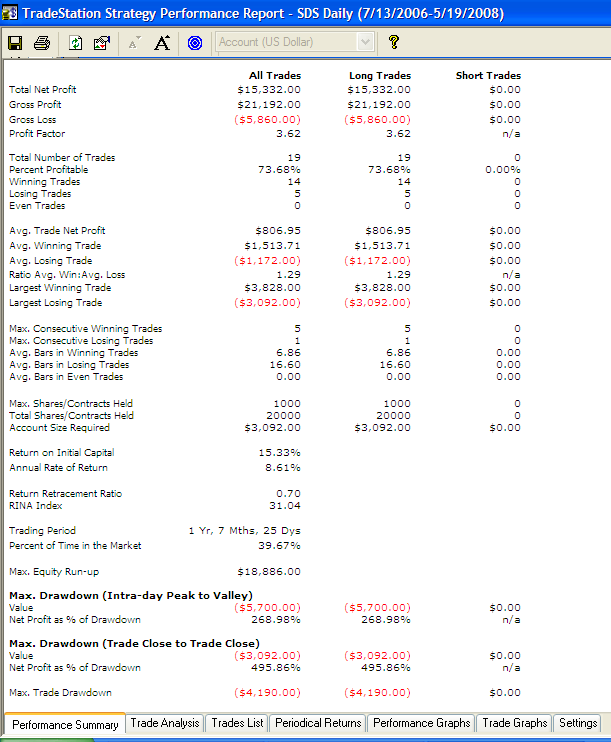

Rudimentary backtesting through Tradestation over the entire history of SDS (just shy of 2 years worth of data) using this strategy yields the following results:

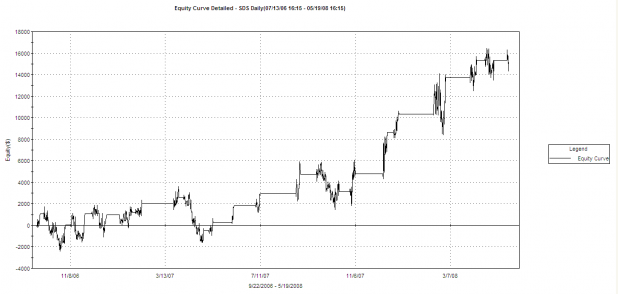

And the equity curve is below:

I do not currently use a stop with this strategy, so beware. The exit triggers when RSI(2) > 80. For the backtesting a 100K account size was assumed, and each position was either all in, or out entirely. I allowed $1.00 per trade in commissions, as that is what it costs me per 100 shares with Tradestation.

Adding a short entry and exit to this strategy doubles the percentage gain and doubles the return on investment, but unfortunately quadruples the drawdown as percentage of starting capital. The results above were from a long only strategy.

This is the best comment, ever!

and some positive karma for you! LOL

Adding… I read all your posts Shed but I’m still not ready to start trading inverse ETF’s based on technical signals only. I understand why you do, but it’s not for me, so I can’t offer anything to your discussion.

Thanks Boca! 🙂

Just a thank you note. This system signaled a buy in FXP last Thursday at $63.44 and signaled a sell today at $67.32 for a 6.12% gain in 5 days. Very nice!

I have been trading in the closing minutes of the day, but that is not working. Twice now I’ve been fooled into making a mistake as the day’s final action altered the signal. For the next few trades I am going to wait for the close, then try to make my trade in the after hours market. Normally that market is too thin, but I think the volume in ETF indexes may be good enough. I’d rather be off by price than by a complete trade. I’ll let you know how that works for me.

Thanks again.

Bob, thanks for the feedback. I’m glad its working for you.

Tonight I will run a backtest over all the data for FXP, just for fun.

I too got fooled by making trades into the close, instead of on the open, based on the RSI(2) closes. I think I’ve entered about 7 trades based on this strategy, and the 2 that are probably going to give small losses are the ones that I jumped the gun on.

Also, I think an RSI(2) close above 80 hints at momentum. By waiting to the open to place the trade, my suspicion is that the momentum works in favor of the trade when closing it. Also, when entering a trade, a large gap down at the opening will give a better price for entry as well. These are my suspicions, but I have not thoroughly tested them.

This system works amazingly well.

BHH- yes, I am fascinated by it. See the latest post re: FXP

This is my first visit to your site. I like the concise idea, and the specifics offered as far as a plan. I do something similar on my site, and try to also expand on the topic of “adding”, that is how much, etc?

Keep up good work, and I appreciate your candidness. If you are interested in my work also, it can be viewed at http://www.itrade4real.com

Good luck and stay in touch!

Guess I should have held on to SDS for another day! Wow!

Dogwood, that exit has over 80% efficiency. In one of the studies I ran, there were many exits that had over 90% efficiency.

SDS is my largest position. Yeah, I’m smilin’.

Joe, thanks. Glad you enjoyed your visit. I’ll stop by your place this evening. Do you have a dress code?

Definitely believe what we said. Your favorite reason were on the internet the simplest thing to know. I say to you, I definitely get irritated while people consider worries which they just have no idea about. You managed to hit your nail upon the very best as well as defined out the slide without having side-effect, people may take a indication. Will oftimes be back to obtain more. Thanks