The major stock and commodities exchanges have instituted procedures to limit mass or panic selling in times of serious market declines and volatility. These mechanisms are known as Circuit Breakers, the Collar Rule, and Price Limits. Circuit Breakers establish whether trading will be halted temporarily or stopped entirely. The Collar Rule and Price Limits affect the way trading in the securities and futures markets takes place. Here’s a description of each one:

Circuit Breakers

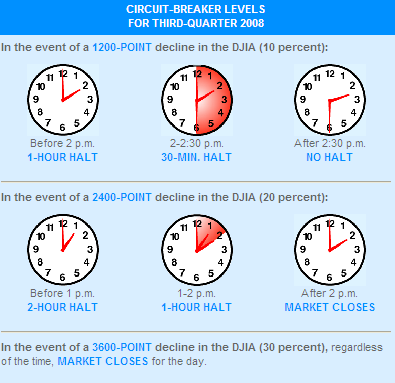

The securities and futures markets have circuit breakers that provide for brief, coordinated, cross-market trading halts during a severe market decline as measured by a single day decrease in the Dow Jones Industrial Average (DJIA). There are three circuit breaker thresholds—10%, 20%, and 30%—set by the markets at point levels that are calculated at the beginning of each quarter. The formulas for these thresholds are set forth in the New York Stock Exchange (NYSE) Rule 80B.

For example, on April 1, 2007, the average value for the DJIA for the preceding month (March 2007) was used to calculate point levels (rounded to the nearest 50 points). This resulted in the Level One (10%) circuit breaker set at 1,250 points, Level Two (20%) circuit breaker set at 2,450 points, and the Level Three (30%) circuit breaker set at 3,700 points.

Collar Rule

Under NYSE Rule 80A, if the DJIA moves up or down two percent (2%) from the previous closing value, program trading orders to buy or sell the Standard & Poor’s 500 stocks as part of index arbitrage strategies must be entered with directions to have the order executions effected in a manner that stabilizes share prices. The collar restrictions are lifted if the DJIA returns to or within one percent (1%) of its previous closing value.

The 2% collar rule threshold is set by the NYSE at a point level that is calculated at the beginning of each quarter. For example, on April 1, 2007, the average value for the DJIA for the preceding month (March 2007) was used to calculate a point level (rounded to the nearest 10 points). This resulted in the 2% collar rule threshold being set at 180 points.

Price Limits

The futures exchanges set the price limits that aim to lessen sharp price swings in contracts, such as stock index futures. A price limit does not stop trading in the futures, but prohibits trading at prices below the pre-set limit during a price decline. Intra-day price limits are removed at pre-set times during the trading session, such as ten minutes after the thresholds are reached or at 3:30 p.m. (all times are Eastern), whichever is earlier. Daily price limits remain in effect for the entire trading session. Specific price limits are set by the exchanges for each stock index futures contract. There are no price limits for U.S. stock index options, equity options, or stocks.

* * * * *

from: http://www.sec.gov/answers/circuit.htm

Trivia: The only time these triggers have been hit was on October 27, 1997.

See this is good shit. This place fronts better info with less and less cleavage and camel toes every day.

Thanks WS.

is that somehow a reference to TGs horrible tragedy of a blog?

“program trading orders to buy or sell the Standard & Poor’s 500 stocks as part of index arbitrage strategies must be entered with directions to have the order executions effected in a manner that stabilizes share prices.”

——————

How do that manage to control this? What does it mean by “with directions … that stabilizes share prices” ?

I hope you are not jinxing this market with this talk of 1200 point declines.

Arrrghh, so annoying that the EDIT function is gone. I meant to say.

How does the exchange manage to control this?

nice reminder. especially considering the times we’re trading in.

btw, shame that the VIX/SPY didn’t produce enough data to make any judgements. You have me thinking about playing with trigger levels should I get motivated today. Anyway, nice work and thanks for the effort.

StockSpeculator, that is my next project, maybe for this evening, to relax the stretched percentage a little and see how many more trades it produces.

My suspicion is that if I had VIX data going back past 2004 that the winning percentage would hold up, but that is just my assumption, and you know what they say about assuming.

The biggest problem is that in times like these, the downside risks can outweigh the fact that this system typically produces winning trades. It is probably not very smart to take on longs during the possibility of a capitulation event, in order to make on average of 1.24% a trade.

I think the benefit from this system is just that we should be careful to be looking only short here.

The other consideration is that during times that are less dreadful, it is probably acceptable to put this trade on, to catch the 1.24% avg. net.

Wood – totally agree with you about news skewing risk/reward ratios. especially during once a century type markets where the entire financial sector is exploding.

I’m 100% in cash, just going to sit it out until this thing sorts itself out. It’s too obvious on the short side right now, and you are seeing the late shorts being run in (GS,JPM, MER, MS)this morning and it’s too crazy with the AIG news still unsettled to even think about getting long. For me at least.

Good trading and again thanks for posting your work.

I agree. I’m 89% in cash. I took one long position this morning, HAE, for a quick trade. Studies like the one above help me to know when it is okay to take contrarian signals like the one I got for HAE.

you only have vix data to 2004?!

Hah!

No better bottom indicator than bloggers posting the circuit breakers.

circuit breakers Says:

“No better bottom indicator than bloggers posting the circuit breakers.”

How’d that work out for ya?