On Thursday, September 18th, the Russell Small Cap Index generated a technical buy signal when the 50 day moving average (dma)Â crossed over the 200dma from below. This moving average cross is typically labeled a Golden Cross.

Has this signal truly been golden, for technical traders?

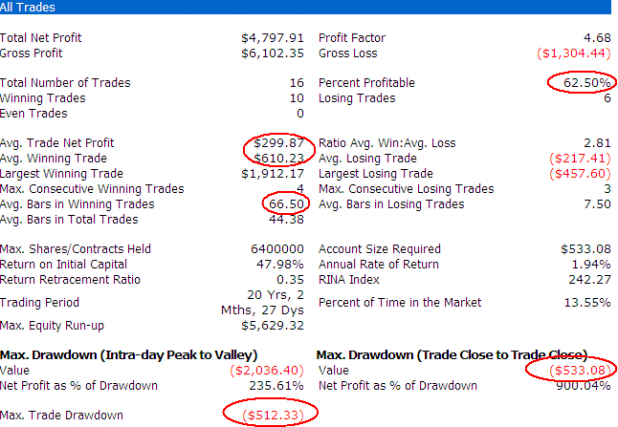

Entry Rules:

If 50dma crosses the 200dma from below, buy next market open.

$10,000 per trade.

Exit Rule:

If the close is less than the 50dma, sell next market open.

Results:

It seems the Golden Cross can be a profitable entry signal, at least on the Russell.

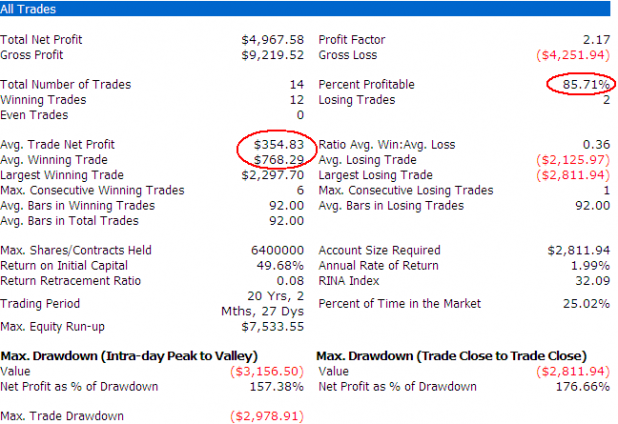

What if we use a time-based exit, instead of the previous moving average-based exit?

Exit Rules:

Exit after being in the trade 90 days.

(90 days was a fairly random number, although I knew that moving average systems like this one typically favor longer hold times.)

Highlights of the time-based exit include a high win ratio and a high intraday drawdown. Profits increased marginally over the moving average exit, with the tradeoff coming in the form of much larger losing trades.

It seems the Golden Cross does typically lead to higher prices, and may offer an early clue that a market rally is near.

The chart below shows the recent Golden Cross.

Note that had the signal been acted upon on Friday, that the first exit rule (exit the next day after a close beneath the 50dma) would have triggered on Tuesday, which means a sell order was placed for this morning.

Â

How about shorter MAs? For example 5-day crossing through a 20-day? I’ve been play around with a 5/25-day MA. Also with 5/30 MA. You can’t catch a bottom/top, but it seems to help with allow one to get into more profitable trades.

Sure, we can check out shorter averages. I’ll work up some tests tomorrow evening and post them here.

What are you using for exits?

Basically, just like the 50/200. If 5 crosses above 20/25/30 then buy, if 5 cross below 20/25/30 then sell. It would be ideal to be able to use or the ETFs like SSO/SDS, QLD/QID, UWM/TWM. For example, the 5/25 on the UWM/TWM has been very useful for 2008.

Hey Woodshedder, what program(s) do you use to run your backtests? Is it a custom deal or some off the shelf software?

Love the backtesting posts, keep up the great work!

Ichabod, I use Tradestation and Stockfetcher, along with some excel spreadsheets.

If it is acceptable to you to not have data back farther than 2002, Stockfetcher is an excellent, cheap and easy to use backtester. Their reports can be loaded into excel to create some additional reports.

Cool, thanks for the reply. I’ve tinker with StockFetcher a little, but nothing really serious. I’ve also toyed with the TD Ameritrade program and a few custom/open source ones, but have never done anything more than tinker. Thanks again!