While I explained in the previous post my intentions to track this system on iBC, I did not explain very much about the system itself.

The System Highlights:

Entry is secret but is not based on volume or RSI.

Exit rule is very simple: If RSI(2) closes above 80, sell at the next open.

This system has been backtested only as far back as Jan 1, 2008. Since the system trades only diETFs (double and inverse ETFs), and many of these diETFs are less than 2 years old, it is impossible to test back much more than 2 years. This should cause concern. However, I have tested this system on the SPY, DIA, and QQQQs, on all available data, and it is profitable. Still, that does not mean that the system will work the same on the diETFs. I am working on this system with another trader, who may or may not choose to remain nameless, and he will probably have tested this system back across all available data for the diETFs, within a week or so.

Here are the statistics, since January 1, 2008:

| Trade Statistics |

| There were 80 total stocks entered. Of those, 80 or 100.00% were complete and or 0.00% were open. |

| Of the 80 completed trades, 49 trades or 61.25%resulted in a net gain. |

| Your average net change for completed trades was: 2.60%. |

| The average draw down of your approach was: -3.25%. |

| The average max profit of your approach was: 5.88% |

| The Reward/Risk ratio for this approach is: 2.63 |

| Annualized Return on Investment (ROI): 268.02%, the ROI of ^IXIC was: -28.53%. |

| Exit Statistics |

| Stop Loss was triggered 31 times or 38.75% of the time.An exit trigger was executed 49 times or 61.25% of the time.An exit trigger was executed 49 times or 61.25% of the time. |

Remember, this system will hold a maximum of 4 diETFs, and will take only 2 new entries per day. Therefore, more trades were generated during the time period tested, but these trades were not taken due to the aforementioned rules. For example, If 4 diETFs are signalled for entry, the system will only take the 2 with the greatest volume.

This method of 2 new per day with 4 max positions is a variable that may need adjustment in the future. More testing needs to be done on this variable.

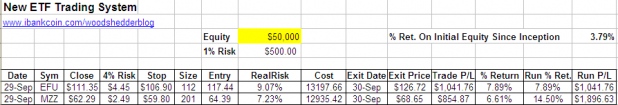

Spreadsheet and Trade Accounting:

I want to explain this spreadsheet. I’ve set it up to make it easy to figure out position-sizing, so orders can be set in the evening before bed. All I do is enter the close amount and the sheet figures my 4% risk/stop, and size.

- “Close” = the value on the day the signal is generated. Used for purposes of position-sizing.

- “4% Risk” = the dollar amount per share risked with a 4% stop

- “Stop” = stop market price to be entered when entry order is placed

- “Size” = number of shares

- “Entry” = actual entry price

- “RealRisk” = this calculation takes into account any opening gap above the previous close. Since the stop level is derived from the previous close, any opening gap will increase the actual risk.

- “Cost” = cost with $14 in commissions, to equal a round trip.

- “% Return” = the Return on Investment in each trade

- “Run % Ret” = sum of the % Return of all trades

- “Run P/L” = a running total of the profits and lossesd

Once more trades are made, the system will generate more interesting statistics, and an equity curve will be plotted.

Gain of 3.79%, Not Bad for the First Day

No Entry Signals for Tomorrow

“I have tested this system from the present to Jan 1, 2008. ”

what does that mean….YTD?

Yep, exactly.

Oh.

Cuz, typically, in English, shit goes from left to right. But what do I know.

—-

Obviously I am busting your balls Shed, nice results.

Yeah, it was a tad confusing. I fixed it, I hope.

The basic stats are encouraging. I should have some more data soon.

you should attend a grammar rodeo.

Are you using Stockfetcher for your backtesting? Seems like that based on the format of your results.

Have you considered a strategy which would select those individual stocks which best meet your criteria? Sometimes it offers even better results.

All the best in your endeavour, I am looking forward to this experiment.

keep up the good work!!, excellent post!!!

Sarcasm off.

The gaps down aren’t much fun, either. EFU was one of my core positions.

Beka, preliminary, proof of concept type tests are run on Stockfetcher.

Further, more intensive development is taking place on Trader’s Studio. The later tests will include differing money management strategies and differing number of max positions and new entries per day.

Hard Right- these diETFs can really give one ulcers, the way they move. However, if the volatility can be captured profitably, they can be huge money trees.

Hey Mexican,

What are your YTD returns?

mexican

why do you continue to go after Woody? what do you have to gain by doing that? he is a tabbed blogger on this site who happens to be right most of the time. here is a man with a regular job that does this because he loves doing it, is better than most at it, and is a tremendous help to everyone here.

mexican, you want to go after someone? come after me, you mother fucking scum bag.

The Mexican’s education apparently ended with arithmetic so he just does not understand statistics and probability. I think we should feel pity for him if anything.

TexMex,

In case you need help calculating your YTD return,

Take the money you have now and subtract (-) the money you had at the beginning of the year. Then divide (/) that number by the amount you had at the beginning of the year. I know that weird number you are seeing with a dot (.) in front of it is confusing. Multiply it by 100 and you will get a “normal” number that is your percentage return. Don’t forget the minus sign.

You guys are totally cracking me up! Thanks for having my back!

Mang, do not get in the middle of a Mexo-Cuban rumble.

Gives a whole new meaning to the phrase:

“Say ‘Hello’ to mah lirrle fren’!”

________

Jake,

LMFAO

sooo true Jake and Chivas, hahaha

Please, PLEASE, mexican, go after Chivas.

“Motherfucker” is just supposed to be a figure of speech!