The most prolific discussions generated by the tracking of the Big Bamboo Trading System have concerned the use of stops. We have discussed using larger percentage stops, Average True Range stops, and no stops at all. (Regarding the use of no stops at all: That is like not wearing underwear. It works well, until you get caught with your pants down.)

The recent work by BHH which compared varying percentage and ATR stop levels was very instructive. The relationship between stop levels and profits cannot be ignored. As the 1.25ATR stop looked as if it performed well in B’s tests, I decided to go back and run all of Bamboo’s real-time trades as if they had been positioned using a 1.25ATR stop rather than the 4% stop.

I think the results are very interesting.

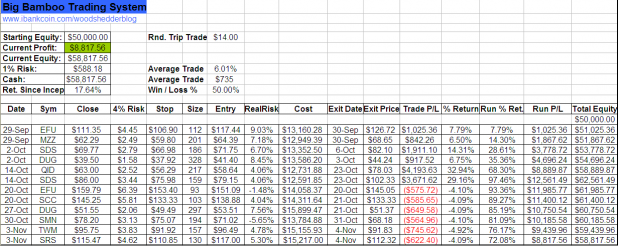

Below is the Big Bamboo tracking spreadsheet with the standard 4% stop.

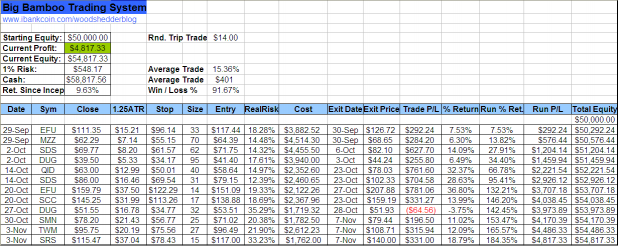

The next spreadsheet is the Big Bamboo using a 1.25ATR stop.

Highlights of the differences between the 4% and 1.25ATR stops

- Total profit on 4% stop is almost double that of the 1.25ATR stop: $8,817 vs. $4,817

- 4% Return is 17.64% vs. 1.25ATR Return of 9.63%

- Avg. Trade is $735 vs. $401

- Positions are much smaller for the ATR stops, getting even smaller as volatility ramps up in October

- ATR stops have 91% win rate vs. 50% for the 4% stops

- Some of the stops are greater than 20% from the entry, giving the positions freedom to gyrate

BHH’s tests contained much more data than is represented in these 12 trades. Remember that ATR stops will allow for bigger position sizes than what is calculated with these trades, as soon as volatility tails off. This example then is really showing the extreme results of using ATR stops, as the volatility in October was extremely high.

Perhaps the best result of using ATR stops was that during an extremely difficult month, the system had only 1 losing trade. This shows the ability of the system to generate profits, with smaller positions, during very difficult market conditions.

new entries for big bamboo for tuesday?

What the fuck is with the malware warning that I get when visiting Fly’s blog?

No new entries. They will ALWAYS be posted the night before they are to be acted upon.

Interesting. The ATR stop consistantly shows gains, while the 4% at one point goes from over 65.5k to 58.8

Is there a way to calculate how much of a larger position you could take with ATR? The overall dollar gains would certainly be closer.

I’m getting a Trojan also, plus half the blogs are blank.

Is Woody staging a coup?

Yes, I’m taking over this place. I’m laser beaming the other blogs, at will. LOOK OUT!

Computer emergency! Vincenzo, to the Batmobile! Fix the site!

Fly spilled oatmeal on the server!

Kudos …. IBC Web site problems!!! Blank screens. access to web site okay but cannot navigate within IBC. Blank screens appear.

Wood, did you or your partner look at the intraday drawdown for both stops (portfolio heat)? That is also an interesting thing to look at with various stops to give traders of the system a sense of what the intraday pain might look like.

Mikey,

Great question. We look very closely at closed-trade drawdowns but intraday drawdowns are a little more difficult with the various software packages we use. One of the advantages of percent-risk position sizing is that you can be assured that your intraday drawdown (per trade) never exceeds your at-risk amount. 1% of portfolio equity in this case. A closed-trade drawdown on a bad gap is the worse-case scenario.

This study that Wood did is really a true gem. This so clearly illustrates how important position sizing is and how win% is rarely the most important factor. The 4% stop and the reduced win% that resulted generated almost 2x the profit. Now compound that over months or years of trading – the differences are staggering.

Good system trading and development is less about the robot trading signals, but rather quantifying the most profitable way to exploit the signals you do get.

Sorry about the long post/hijack.

Happy Anniversary Woodrow, Fly, RC, Danny, Green Writer, Dpeezy and everybody else that is here – by the way, woody, its time to scrub down your new now 1 yr old shower and I want to see photos of the scrubbing as you do it. Gots to keep the site clean!

BHH, great response. Thanks for helping me keep things going.

Buylo, I was noticing a few little spots of mold next to the shower door. I’ll take care of those tonight when I get home.

lol, forgot about the shower. Good call, buylo.

since my comments are unaccessible for some reason, thanks for the comments last night.

inaccessible? un? dammit.

Wood, Have you done any studies letting the 1.25 ATR position run? How about adding to the position after the position rose 1/2 ATR? You are on track with your studies, but remember what Faith said , let your winners run while at the same time ADD to your position.

Enola, I hope in the next few months to have in development some strategies that have a longer time horizon. This one is strictly designed to be short term, hopefully averaging about 6 days a trade.

The CAGR on this system, with a 4% stop, will trounce most of Faith’s trendfollowing systems, with a much lower drawdown.

My bias is this- I hate to hold positions for more than a couple of weeks. I also hate drawdowns. So when I work on systems, I approach them with the idea of maximizing profits in as short a period of time possible, while minimizing drawdowns.

Although, as I said earlier, I do want to incorporate a good trendfollowing system into the current bevy.

I understand you reasoning, but I think you will could leave a lot on the table when a great play comes along. Oh well, everyone MUST

be comfortable in his own system. Good luck

Enola, when the indexes start to trend again, more will be left on the table. Keep in mind that this system is only traded on the index diETFs.

However, until that happens again, it is doing a great job of capturing swing profits.

ta9de104mcr5mvkm