On November 13th, I suddenly and somewhat inexplicably became bullish. Well, honestly, there were some technical reasons, but more than that, my change in sentiment was purely due to a gut feeling. Feel free to re-read the post here: I’m Very Very Bullish.

Four of the five trades I put on after that post stopped out. APOL is the only position I’m still in. It has been doing well for me. Anyway, I’m still somewhat inexplicably bullish. I do plan to begin establishing some “feeler” long positions, once the indexes break above resistance.

The following are some charts that I think can make some good hedges if one is looking for exposure on the long side. If the indexes want to make another run against overhead resistance, I may try some of these trades, in anticipation of continued strength. These positions should be small, and should not be risking more than .5% of total account value. Positions made in anticipation rather than after confirmation should be kept small, initially.

DMND looks interesting, if one can stomach the ATR(10) volatility of 6.4%

HMSY is making a nice pullback to support. Volume picked up on the the up days. A Golden Cross is going to be completed very soon.

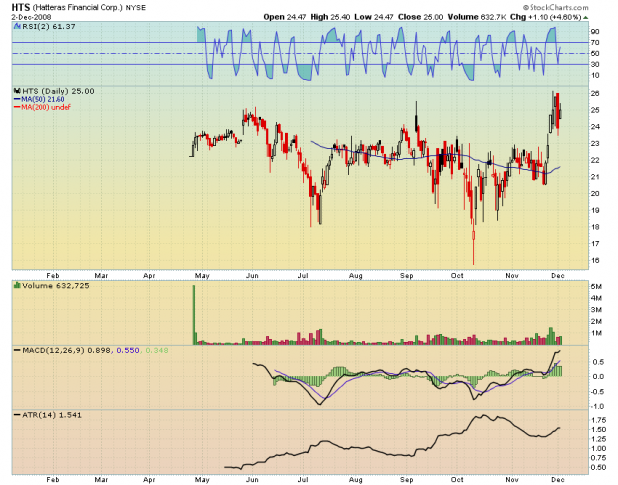

HTS is a ragged looking IPO. Still, its strength over the last 7 months should not be ignored.

LHCG is stair-stepping up. Will this breakout fail?

TCBK is not very liquid, but volume is increasing.

TSYS may be my favorite chart of this group. I really like getting in breakouts from triangles.

WTR has made a nice pullback after a breakout from a flat base.

j Says:

Shed

Do you move your stop loss levels a trade is placed or do change them if the position moves into a profit?

j, with my system trades, I rarely move the stop loss. If I do, it might be because I added to the position, which means I need to tighten the stop to keep risk the same. Backtesing of these trades show that it is best to just let them work, or not.

With my discretionary trades, come to think of it, I rarely move stop losses, either. For example, in my APOL trade, my stop is still set 1.25ATR beneath my entry, even though the stock is now 6 points above my entry. As it is more of a long hedge, I want to give it room to swing.

what’s the word on EBS? the bullest chart in 5 counties.

What does the mighty BigBamboo say for Wednesday? Did i miss that? If i did, can u tweet it every night. Thanks!

BOTD, I didn’t include EBS as it is going, or has gone, parabolic.

Gio, no new entry signals for the Big Bamboo, for Wednesday. When there are signals, I will ALWAYS put a post up the night before they are to be acted upon.

Thanks wood for the charts!

The major problem with those picks is that they are all low volume stocks. In fact, these are the only type of stocks that have been showing up on my screens which gives me about zero confidence in this market moving higher with that type of leadership

I too was becoming bullish at just about the same time as you and got nailed by that low volume holiday rally. This market has been about as difficult to trade as I’ve ever seen so maybe you’re right to be bullish now.

Jeff, I don’t disagree with you.

I too keep getting nailed, anytime I trade anything but system picks.

However, I think we’ve got to keep an eye on what’s working, in case the indexes can ever rally.

Check out QCOR.