The VIX stretch setup is simple. When the volatility index is stretched x % above or below a moving average, a trade is generated.

My testing shows a stretch of 15% or more beneath the 10 day simple moving average suggests a reversal is near.

As the VIX moves inversely to the indices, a stretch beneath the moving average means the trade would be on the short side.

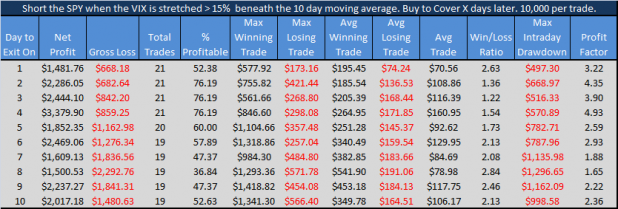

The following sheet shows the results of shorting the SPY on the open after the stretch occurs and covering X days later.

The testing covers 10 years worth of SPY history, but there were only 21 total trades. The setup achieves over 75% profitable with a profit factor greater than 4 within a couple days.

By day 6 (which really means the trade is exited 7 days after entry) the percentage of profitable trades begins to decrease and the max intraday drawdown begins to increase.

Today the VIX closed at $39.66 and the 10 day moving average closed at $47.15

$47.15*.85 = 40.08. Thus, the VIX close is stretched more than 15% beneath the 10 day moving average. The system has signaled a short entry on the SPY tomorrow morning.

Nice screen shot

Nice work finding that one.

The SPY is 2.57% above the 3DMA and in the last twelve months the average has been .78% less than the 3DMA +- 1.83.

That puts the SPY at about 2 sigma.

The highest the 3DMA was last year was about 5 sigma above the 5DMA.

What program are u using to backtest the data?

Another mean reversion type trade. Nice work.

Interesting piece from Ritholtz.com

http://www.ritholtz.com/blog/2009/01/bianco-the-dow-is-distorted/

Is there an indicator of bullishness if it goes 15% above the 10 day simple moving average?

awesome stuff. The Vix yesterday was very flat, despite that strange move to 33.80. wow that was weird. anyway, if we hold this support, i’ll be adding to shorts. oh yeah, in my experience news-driven tapes tend to skew the Vix data.

i wonder why IBD doesn’t do more articles like this one. They base all their trading rules off “how the market actually works” through years of back testing. great info and whether used for trading or not, very interesting.

Wood – Thanks for the idea. It seems to be working nicely today.

Cuervo, I can’t really take credit for it. It has been a fairly well known setup.

Glad to see you’ve been working on the stretch…

jjjsix, check out this link for the bullish setup:

http://www.ibankcoin.com/woodshedderblog/index.php/2009/01/16/using-the-vix-to-trade-the-spx/

Ferrari- tradestation. However, this is one of those setups that if you have charts going back 5-10 years you could backtest by hand.

Alpha, mean-reversion is king, until it isn’t anymore. Who knows how long that will be?

Hi Wood,

I really like your blog, very interesting stuff, just want to make sure I understood correctly this system according to the previous time you posted this VIX trading method, you used 10% below the 10 moving average to start shorting the VIX at the next open. If that previous system would have been used than we would have entered the short on SPY at yesterday’s open? Am I right or am I missing something. Thanks in advance for all your help and commentaries.

Hammy, the IBD “breakout” style of trading is quantifiably not working, and hasn’t really been working very well for over 2 years. As long as mean reversion is king, momo and breakouts will not work as well. Doesn’t mean you can’t trade breakouts. It just means you should be selling them instead of buying them.

Elkate, yes I did use 10% on the last one. I’m not sure why I used 10%. Honestly may have been a typo in the code. Anyway, 10% still works. 15% works. Basically, mean reversion works.

I believe without looking back at Tuesday’s close that you are right, the short would have been entered on Wednesday’s open.

@Wood: Well, I’ve been asking myself why the 3DMA is so important.

Still no answers but anything involving it generally rises to the top in any of the GA back testing I’ve been doing.

As for a “stretch play” how’s this one:

Divide the Adj Close by the 3DMA.

Then, any time the ratio drops below .97, buy 100 shares of SPY.

Jan 08-Jan 09 Stats:

Max drawdown -335

Max win 667

Average trade 255.8

Standard Deviation: 314.23

Total Trades 10

Capital 11.1k

Percentage Win: 31.17

ChiScore: 8

Cuervo, I’ve been telling you why the 3MA is so important. The market over the last 2 years especially but over the last 10 years has become one mean sonofgun mean-reverting machine. It cannot and will not keep trading around the extreme short moving average.

Go back a few years with the 3 day and see how it starts working really really well. Then test back over 60 years and see how it never ever worked, until recently. Then go back and test it on the DJI, during 1929-1933. 29-33 will look very familiar to you. Trust me.

Trading that short of a MA for any length of time is likely going to destroy your account. Yes it works well now. How do you know when it stops?

The key here is to get the other thing you’ve been working on as bombproof as possible in terms of evaluating these things.

Mean reversion is probably one of the most statistically valid concepts on which to base a trading system. That, and a time machine.

Then go back and test it on the DJI, during 1929-1933. 29-33 will look very familiar to you. Trust me.

Thanks – now I have something to work on over the weekend.

The 3DMA is rising to the top recently because that is what other people are looking at. Thus, it is self-fulfilling in many respects. It also reflects the perceptual psychology of traders. When a longer term perspective is adopted the best fit for the crossovers will shift to a longer time frame. The “curve-fitting” procedure will always be post hoc, and it always be modified to reflect the best fit. So, never expect fixed variables.

Manuel, the 2DMA actually optimizes the best, at least on the SPY. I’m pretty sure also the Qs, but I’m not positive.

My point is that when the index is vacillating around the shortest possible of averages, it can only move up. It can’t vacillate around the 1DMA.

I think one way to approach it is to know that at some point, it will begin trending more. Therefore, look at building around the 5-9 day average, as that is the direction it will move toward.

Hi Wood, Great Idea

Here’s a chart using MA envelope set at 15% that gives a graphic representation for the system…saves having to calculate it.

http://stockcharts.com/c-sc/sc?s=$VIX&p=D&yr=0&mn=6&dy=0&i=p27508210443&a=139227181&r=2213

@Wood: Yep; agree completely. Indecision gives rise to shorter average periods. Breaks in the slope of a trend significantly intereact with the optimal crossover averaging periods. Less indecision will increase the averaging periods because there are fewer breaks. I sure am looking forward to that…