The system closed out the SKF position at this morning’s open.

As I noted in previous posts, the win % is slowly climbing back up to where we would it expect it to be based on historical results (in the high 60% range).

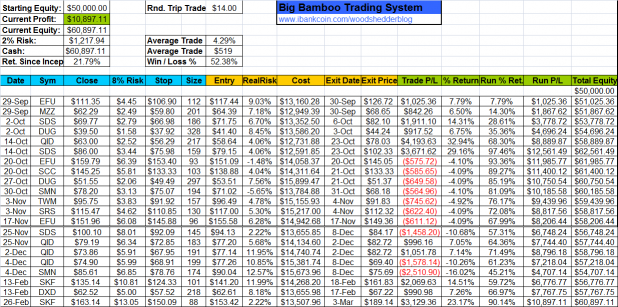

This was the 21st trade. I would like to have 30 closed trades before I make too many assumptions based on the data, but I have to say that the average trade is looking pretty sweet.

Also, the 21.79% since inception is not too shabby.

Still, I think this system can be improved, as I noted here.

I do not see any signals for tomorrow’s open, but if anything changes between now and the close, I’ll update the site.

Stay tuned…

3 nice wins in a row. what triggered the sell today?

Sell was triggered when RSI2 closed yesterday above 80. All trades are made on the open.

Woody!

First of all: thanks for a terrific site, much appreciated.

I walked in your footsteps on the SKF trade, and I can’t say it hurts.

Just wanna ask you something: you’re saying all your trades are made on the open. The entry price Feb 26th was around $153. That day SKF had a “U” like move. Are you saying you took the position directly at open, or the second time that day that SKF hit the $153 area?

I’m not asking out of curiosity, it’s actually a pretty important trading technique issue for me: thing is I entered the position pretty much directly at open, but was later stopped out around $149 at the “U” bottom. I later re-entered the position @Friday close since I didn’t think much of the market in general at that point.

Sorry for being babbly here. I’d be very happy tho if you could enlighten me on how to deal with this kind of situations.

Have a nice day, thanks again /Schenkmanis

Greetings Schenk. I take the position directly at the open. It is therefore critical to use a diETF that is very very liquid.

You must use a stop that works for you, but after testing this, 8% works well. Had you used 8%, you wouldn’t have been stopped out.

I do not trade during the day, for the most part, so the way I handle these types of situations is to put in my order the night before, set an offset stop (meaning it will be 8% below whatever price I enter at) and then I forget about it until it stops out or the exit criteria is met.

I see. Yeah, using the right stop is really hard I think. 8% is a bit too much for me, but maybe I should reconsider when it comes to lithium popping ETFs like SKF – or even more so, FAS/FAZ.

So, with an 8% stop I take it your stop level in this case was around $141 (and not $150)? Or am I totally off here?

/Schenk

Schenk, if 8% seems to be too big of a stop, you might be using too big of a position size.

141.05 was the stop.