QID gapped below the stop this morning, costing the system .30% more than planned. It hate it when trades hover near their stops for extended periods of time. The psychological ramifications notwithstanding, they will often gap beyond the stop on the open, as QID did.

SDS and DXD closed in the good.

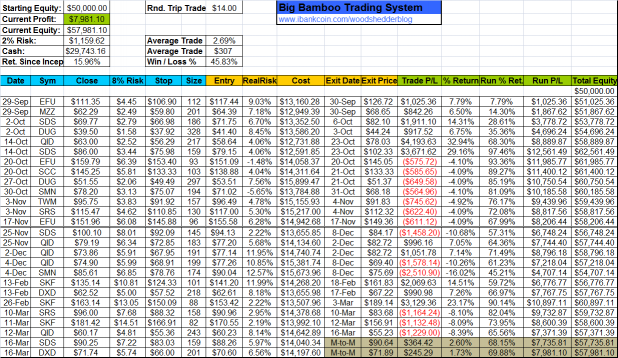

The Bamboo really has to make something happen here. Two more losers, making another five in a row, would really hurt.

Behind the scenes tonight there is work happening on a better Big Bamboo. Eventually, all the issues listed here will be addressed. When the system emerges, it will hopefully be lean, mean, and green. And, the signals may become available as a premium service, IF it turns out to be as good as I think it might.

Stay Tuned…

fuck me and my stupid theories, USD/JPY is on fire, shorts look like will be broiled tommorrow.

You might want to look at serial correlations in your returns. It appears that the system’s losses come in streaks. You might get a higher expected return by only taking a trade if the previous trade was a winner. Although having multiple simultaneous positions makes things more complicated when trying to do that.

What jkw said is the smartest thing I’ve read in a long while.

Cuervo and JKW- already done. Look below:

http://www.ibankcoin.com/woodshedderblog/index.php/2008/10/05/trade-statistics-from-the-new-etf-trading-system/

and more stats here:

http://www.ibankcoin.com/woodshedderblog/index.php/2008/10/06/equity-curve-drawdown-and-trade-distributions-for-new-etf-trading-system/

This all needs to be updated, but since we are re-doing the entire system, we will probably not update but instead publish the new stats for the new system.

makes sense, if it’s a “buy the dip” and the bottom drops out, no sense in continuously trying to catch the falling knife. Sometimes “buy the dips and sell the rips” market turns into “sell the breakdowns and buy the breakouts”, being able to adapt certainly would seem to be rewarding. Maybe not neccesarily avoid a trade after a losing trade, but to avoid a trade if the average of the last 5 is below X% and 1 or more are losing just as an example. I don’t really know though I’m just speculating.

Another alternative may be to do half position sizes, or double position sizes depending on if it’s had recent success or not. That way you still invest in a system that works even if it isn’t as successful when it’s had a series of downtrends, but you limit your exposure.

Of course, you could also switch from the double inverse ETFs and double upside etfs to the regular inverse etfs and regular upside etfs and maintain the same position size when the trades seem to be working against you. If the triple etfs have success, you might bump up to those when the BigBamboo has a high probability of success. Just building off jkw.

keep it up.

Free advice: Buy SKF on 3/31, the crash resumes in earnest April Fool’s Day.