As mentioned in the previous post, running a backtest of the Double 7s system on different platforms exposed inconsistencies in the data used for the tests.

Comparing each platform’s trade-by-trade report shows that data provided by Norgate had 14 instances of prices that did not match the prices provided by Tradestation data. Many of these inconsistencies seemed to be caused by consecutive closes at the same price. There were 12 trades taken by Tradestation that were not taken by AmiBroker. Most of the errors were found in the first 2 years of trades.

While it is possible the code and settings for each platform are not exactly the same, after examining many of the trades in charts, the inconsistencies seem to extend from different data vendors. I do believe the code is working the same on both platforms, but that the data I’m using with the AmiBroker platform is different. I will probably email the vendor and inquire.

Alright, enough robot talk, here are the results:

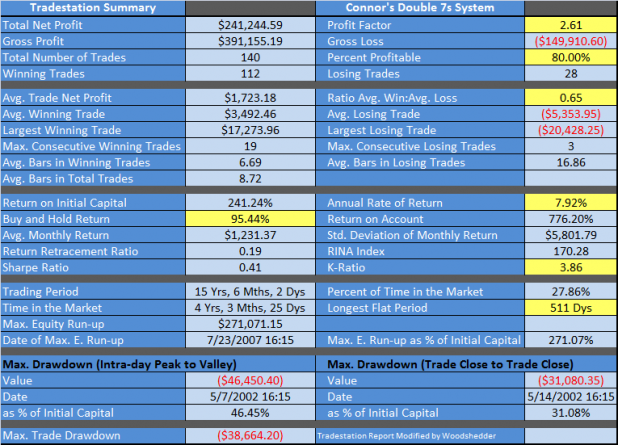

Tradestation Report:

The metrics I find relevant or want to make mention of are highlighted in yellow. Because the system periodically shuts down when price dips beneath the 200 day average, it is somewhat restrained in terms of its ability to generate a large annual return. The system did more than double the buy-and-hold return.

Note the good profit factor, high win%, and high K-ratio.

The ratio of average win:average loss is a tad low, and the last trade the system closed was on 11/28/07.

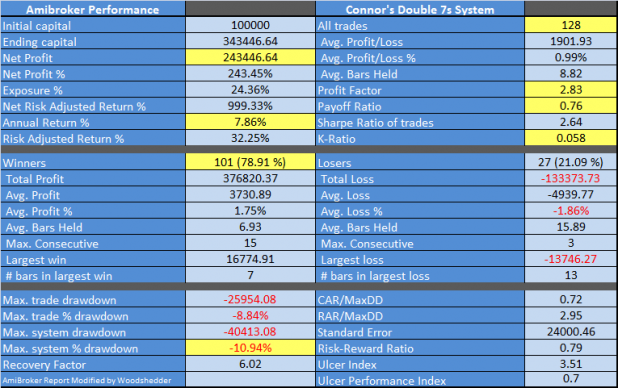

AmiBroker Report:

I like the AmiBroker report as it shows some key metrics in terms of percentages. When trading an index, it is important to calculate gains in percentages rather than dollar value as the percentages can be applied to projections of performance into the future.

Note the slight differences in some of the metrics. This is to be expected since the system traded fewer times and the data seemed to have some inconsistencies. Still, results are very similar, as we would hope they would be.

One of the metrics that AmiBroker includes in the default backtest report is Max. System % Drawdown. The Double 7s shows a -10.94% drawdown, which is decent, but with an annual % return less than the max system % drawdown, there is room for improvement.

Tradestation shows a max system % drawdown of 14%, which is almost double the annual return.

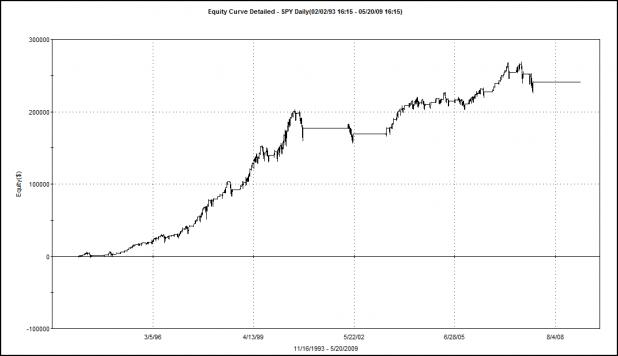

For the visually stimulated, here is the equity curve of the Double 7s, generated by the Tradestation data.

What’s Next?

Because I think it will be fun to compare my results, which were compiled on the same platform and theoretically with the same data, to the results published by TradingMarkets and Connors’s, that is what I will do next.

Once the comparison is out of the way, the tweaks, modifications, and optimizations will begin. I believe the easiest way to make the Double 7s earn more is to provide it more opportunities to earn. A simple way to increase opportunity is to let the system go short. Testing a short setup that is symmetrical to the long setup will likely be the first test I’ll run.

blogreader paydirt. thanks

for a long short system, i’d think it would be good to have a rolling optimization of period lengths, to match phase rate to various volatility environs

FINALLY ! !

Excellent work ! It is certainly refreshing to see published backtesting work that is clean, reproducible, and does not use carefully “selected” dates and examples.

You have to be congratulated for your honesty !

Thanks

eb

Chemical Hairpiece http://synthetic-wigs.dolabuy.com/ World wide web a range of brand Chemical Your hair Hairpieces, Prolonged Artificial Hair pieces, Very low priced Artificial Hair pieces, Short False Hair pieces, Flip Artificial Hairpiece and even more

I wish to thank you for that efforts you’ve put written this internet site. I am hoping exactly the same high-grade website post from you in the upcoming furthermore. In simple fact your creative writing abilities has influenced me to get my very own website currently. Actually the particular blogging is spreading their wings fast. Your create is an excellent example from it.