Once again, the system prevailed, forcing a hold of [[SDS]] over the weekend. SDS was sold on the open, into the large gap-up.

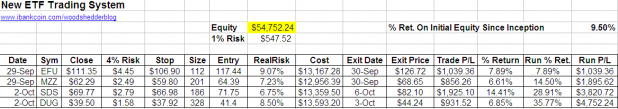

In exactly one week, the system has generated a return on starting equity of 9.5%

Due to these gains, our 1% risk amount has increased by almost 50 dollars.

No signals for Tuesday.

Woodshedder,

I appreciate what you’re doing with this. I actually use Fly’s views for my option account and I use your ETF system for my Roth. Either way, I only use ETF’s for my Roth and you’ve been spot on.

It seems a bit egomaniacal to continue raving about this secret system. Either publish the system or talk about something useful or at least interesting.

Balin, the system is published. I publish the signals every night, giving one about 12 hours to act on the signals, if they were to choose to. The only part that is secret is the entry. The entry is only one part of a system, although many traders think the entry is everything. It is not.

As I outlined in the initial posts, this process is as much about understanding systems, and understanding how to evaluate systems, and the psychology of trading systems, as it is about the mechanics of the system itself.

If you don’t want to read about it anymore, frankly, I could care less.

The fact of the matter is, while the market has been crapping all over itself, this system has earned almost 10%.

In this type of environment, I refuse to put up some charts, draw some lines, and make some educated guesses about where things might go. That is ridiculous. Almost nobody has an edge right now. If you think you do, please, put up a post in the PG and tell us about it. As long as this system has an edge, I will continue to post the signals, as well as analysis of the trades. When the market gets back to something more normal, then I will resume more basic TA posts.

Hey Wood,

What brokerage or trading software do you use?

Do you have any recommendations?

Big Mike, I have 2 accounts- One with Tradestation and one with Scottrade. I use both. The tradestation account is tracked by Covestor. The reason I keep Scottrade is they have awesome fills. I think they take the other side of every one of my trades ;). Seriously though, almost always, I will get the opening price with Scottrade, which is very important when one is only placing orders on the open.

I like Tradestation, except the learning curve has been steep. Eventually I plan to open another account with Interactive Brokers.

Scottrade is good for beginners, and their commissions aren’t bad. If you are trading enough size, a flat rate can be cheaper than per share rate.

If you have any specific questions about any of the features, I’ll be happy to answer them.

I use ThinkorSwim, but I have heard good/bad things about Tradestation.

Most of my trading however, is based on fundamentals rather than technicals…I also use Etrade/Ameritrade as backups…Would you recommend getting Tradestation?

With this volatile environment, I would feel more comfortable with something that process things quickly.

Big Mike, unless you are trading 5K shares/month, Tradestation will charge 99 bucks for the platform use.

From what I understand about ToS, it is a great platform.

I think since you are more of a fundamental guy, that tradestation won’t be of much help in terms of strategy development, but I could be wrong because I only use the technical tools.

Woodshedder, What would be a minimum amount of equity to trade this ETF system? I currently only make discretionary trades and have not traded any systems for a number of years. I’ll be revising my trading plan for next year in the next couple of months and might consider a system such as this. BTW, I’ve enjoyed your posts about the development of the system.

My current trading style does not make many trades per year and tries to capture the major moves, while allowing a small percentage of capital for short term trades and special situations.

Thanks alot Wood…

Yogi, since there is not a lot of history for this system, figuring minimum equity is difficult.

The fact that it doesn’t trade all the time, roughly 80 trades a year, means commissions should not be too much of a concern.

The drawdowns have been very very low, but again, not a lot of history.

I’ll go out on a limb and say 10K? Really, that’s hard to gauge.

OK. Thanks. I’ll keep an eye on it. One of my “projects” is to go back and calculate my drawdown and rate of return on my current trading style. It’s one of those things that gets dropped when things get hectic. BTW I also use Scottrade and I’m happy with them, but do you know if there is any way to get (as in download) the end of day equity in an account?

Will look forward to your post tonight……..

I should have stuck with the system that you and Danny got going. I got sucker into this “rate cut” shit. damn.

pissed at self……….

richard

Woodshedder Says:

Holy cow I’m yet again in awe at all the rationalization.

What the hell?

Folks, there is no rationalization. It is as bad as you think it could be.

You’ve got the bailout, the .50 cut, and you see that there is still selling, redemptions, and margin calls.

Why is it acceptable for the market to run up huge on fake profits, but it is not acceptable for the market to erase all those gains when the reality of the scam and fraud is realized by the masses?

Fuck it, I’m putting up a post tonight with nothing but my fucking opinions on all this idiocy. The bears should be partying, and pressing their bets. The bulls should be in cash. Somehow, the bears are in cash, and the fucking bulls are still pressing their bets.

Insane.

No offense to my friends who are long. Truly, I can’t figure out why everyone is so confused about what to do here.

October 8th, 2008 at 6:24 pm

See my response to this asshattery on Fly’s last post (where Wood posted it.)

He is trying to make a Woodshedder bottom for us all, that’s all. 😉

_

Yeah, that’s it exactly, Jake, trying to make a Woodshedder bottom for his friends.