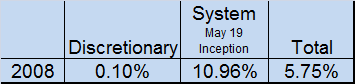

After finishing my accounting for 2008, I will have to amend my numbers a tad from where I reported them in Part 1. Take the report for what it is: not audited. The results include all commissions, charges, and platform fees.Â

In May, I split my account in half, using one-half for only system trades and the other half to trade as I see fit. In 2009, these accounts will again be combined to only trade mechanical systems.

What Worked in 2008

- I will always remember 2008 as the year of Reversion to the Mean. The system that I traded almost exclusively (except for 3 trades) in my system account is a mean reversion system. The metrics posted in Part 1 are a testament to how well these types of systems performed.

- Strategy Development: With a lot of my own work and the help of other bloggers such as Damian, Michael, Brandon, and Rob, I was able to develop 6 mechanical systems. These systems are all due to be deployed in 2009.

- Covestor: Registering with Covestor was an important development as it allowed me to demonstrate (we’ll call it auditing-lite) the performance of one of the systems as well as increase public interest in my blog and the systems.

- Rhythm: In 2008 I finally hit a nice rhythm where I was able to balance the demands of working full time, blogging, trading and developing systems, and having a family. Credit to that goes to trading mechanically for most of the year as it required less time and emotional input than a discretionary approach.

- Volatility Stops: I’m not going to expound on them right now, but these are the ultimate survival tool in markets like those we saw in the first three and last three months of 2008.

- Position-Sizing: Again, no need to expound here, but effective position-sizing was the other key to surviving (and profiting) from 2008.

What I Could Have Done Better in 2008

- More Risk!!! I should have taken on twice as much risk per trade. Almost all trades in 2008 were sized to lose .5% of total capital. In hindsight, it seems ridiculous, with a system that was right more than 75% of the time, that I didn’t risk more in each trade.

- More Opportunity: As the indexes dislocated themselves daily, the systems began providing fewer and fewer opportunities. As Opportunity x Expectancy = Profit, fewer opportunities, coupled with too little risk, resulted in performance that was 1/3rd of what it could have been. In hindsight, I should have loosened the parameters of some the systems. This would have theoretically lowered expectancy. However, expectancy would still have been positive, and more opportunities in the volatile environment would likely have made up for the decrease in performance.

- Lower Commissions: Unless you are trading a size that benefits from a flat fee per trade, per share commissions are the only way to go. I will not go through 2009 paying a flat fee per trade. Per trade commissions alone subtracted better than 2% from my total return.

- Stupid Discretionary Trades: Even as I realized that I was failing as a discretionary trader, I continued to make some discretionary trades. This was not healthy for the account and has been discontinued for the foreseeable future.

New for 2009

- Full 3rd Party Auditing on all master accounts and likely on individual strategies.

- Better and more comprehensivetesting of ideas on the blog. I’m looking forward to having more time to spend looking at the strategies that other bloggers such as RipeTrade and BZB write about.

- More live system tracking, similar to what I’m doing with The Big Bamboo.

- Developments in scalability on some of the strategies.

- A formal partnership and trading business, Algorithmic Capital, LLC. (More on this in the near future).

I have a distinct feeling that 2009 is going to be a very good year. To all the iBC bloggers and everyone else, I wish you the best and most prosperous year yet.

Nice post. I just had a question as to how you program these systems, where you do, and how you learned? Just a little background would be helpful. Thanks.

Thanks Da bears.

Start with Stockfetcher. Their code is really really easy to learn. There are many sample strategies to be found on the forums. From there, if you enjoy it and are successful, then you might try TradeStation, Traders Studio, or AmiBroker.

All the systems I use are traded by humans and are not automated.

I learned from reading blogs and websites, and emailing back and forth with other bloggers, almost exclusively. There are a lot of books out there that can give a good overview (Encyclopedia of Trading Strategies is a good place to start and is all over the internet in .pdf)

thanks a lot

Wood,

I think I’m slowly coming to the brutal realization that you did in 2008 about discretionary systems. Some of us, especially with FT jobs, just dont have the skill or ability to successfully employ such a strategy (if you can call it that). I will spend a good portion of 2009 trying to develop my abilities as a systems trader and hope to be able to add some value on all the system trading blogs.

Keep up the good work!

Wood,

What are your thoughts on EUO? Its the UltraShort Euro (/dollar).

It just was launched not too long ago. I think it could get some attention if the pound and or the Euo collapse as people are starting to speculate?

Great post Wood – here’s to BIG things in ’09! michael

Wood,

I am looking forward to your posts in 09 as well! Great work and thanks for providing insight for us FT workers!

AN Mike, I took a look at $XED, which I think is what the EUO is tracking.

$XED Chart

Over the next few days I wouldn’t be surprised to see a little more downside and some stabilization, maybe a small bounce.

However, a trip back to the 50 day average would seem like a reasonable target over the next couple of weeks.

Based purely on the technicals, and assuming EUO does track XED, I would not be ready to go big in EUO. Friday was really the first weak day in a long time. As of yet, there are no clear signs that the trend is bending.

If EUO is tracking something other than XED, let me know and I’ll take a look at it.

B-rad, my best advice to you would be to look at stockfetcher, if you haven’t already. Very inexspensive. You can develop some basic systems, and stockfetcher will email you the entry signals each evening. You will then enter the stocks and use the exit signals you developed in the stockfetcher backtester. A lot less time consuming, and it will remove SOME of the emotion you are likely feeling at work.

Once you can find an edge and feel reasonably certain it is sustainable for some time, it is much easier to place trades and then remove them from your concious mind

(at least more than with discretionary trades 😉 ).

Some people are built to trade discretionary systems. I would bet that most people should not be trading a discretionary approach.

Finally, once you can see trading in terms of Opportunity X Expectancy = profits, it just becomes a numbers game. Unfortunately, you must either keep very detailed records of every single discretionary trade, including why you took it and exited it, or you must have a system with a separate entry and exit criteria so that Expectancy can be calculated.

I look forward to your development!

nice post. I think more bloggers should be as transparent as you.

Wood,

Thanks for your detailed and sincere review, much appreciated.

You mentioned flat fee brokers, which do you find with both flat fee and good execution? I currently use IB, and like their execution, but the quantity based commissions are starting to kill me.

Best wishes for the next year!

Chile, my only experience with flat fee brokers are Scottrade. I have used them since I first started and have only had a few problems over the past 5-6 years. However, they do not offer many of the order entry capabilities that one would need to become more professional in his trading.

Also, check out EBs post in the peanut gallery. He is moving some size and is using a flat fee agreement with Schwab. He might be of more help.

I’ve seen Tradestation offer a flat fee. You might try calling IB and see if they will work out a flat fee arrangement with you. Maybe you threaten to leave? The only problem with TS is that you must trade 5K shares a month to avoid the platform fee. This is probably not a problem for you.

I looking forward to the day when I’m moving enough size to warrant going back to a flat fee arrangement!

Woodshedder,

What software do you use to backtest your strategies? Thanks,

H

Wood,

Very nice, looking forward to your post in 09.

wood…

are you on twitter?

Hey Wood, great posts as always. What resources have you looked at/read WRT starting your own capital management company? I’m interested in some of the details on that if you don’t mind sharing.

On the broker front, I use IB and at $1/round trip for the small lots I trade you can’t beat it. They also have a sweet API so you can automate anything you want if you know a little bit of programming.

Disclaimer, I’m a professional nerd so I know a lot of programming, but still, it’s really hard to beat their fees and API (although Ameritrade has a pretty good API too from what I understand).

Using one of those APIs you might be able to fine tune next day entries for your systems automatically.

Duane, yes. I believe I’m Woodshedder on twitter, just like here.

Ichabod, books from Amazon, articles on the interwebs, and conversations with a few people that are or have been in the business.

I will likely have a great deal more to say about the whole thing in a month or so.

I checked out IB in real-time last week. I like the interface. It would not be bad to use both Tradestation and IB, for redundancy. One thing that has recently come to peeve me about TS is that they do not offer MOC orders.

Re: programming…I’ve been spending a lot of time over the past few weeks trying to get up to speed with Tradestation’s easy language. I want to code more complex strategies. Basically, I suck at programming. It is like learning how to speak, all over again.

morning wood…

i found you… thanks again…

duane